Understanding inflation, ideology, and bargaining wages

There are many contradictory definitions, explanations, and policy responses to high inflation. Understanding the differences is important to develop the correct orientation to these pressures on workers' wage demands and the left's policy responses.

Inflation

Contrary to popular opinion, not many people – including experts, economists, and political scientists – understand or can even agree on a definition of inflation. Even fewer have considered what causes it, the real impact on the broader economy, or wages over time.

Many people do not realize that there was no inflation as we see today before the mid 1930s. Many of those who do know this think it has something to do with the rejection of the "gold standard".

The "Left" often like to blame capitalism for inflation, believing that you cannot have one without the other.

Statistics agencies publish different consumer price indexes (CPI) trying to measure average rates of growth in prices of things.

The central bank talks about interest rates, input prices, and price pressures from an economy that is growing too fast.

But none of these explain the cause of inflation or provides an adequate measure of it.

First, some standard data representations of inflation

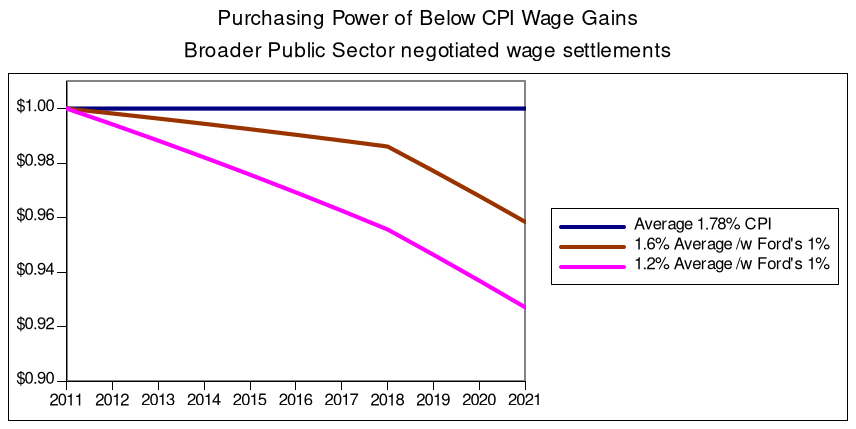

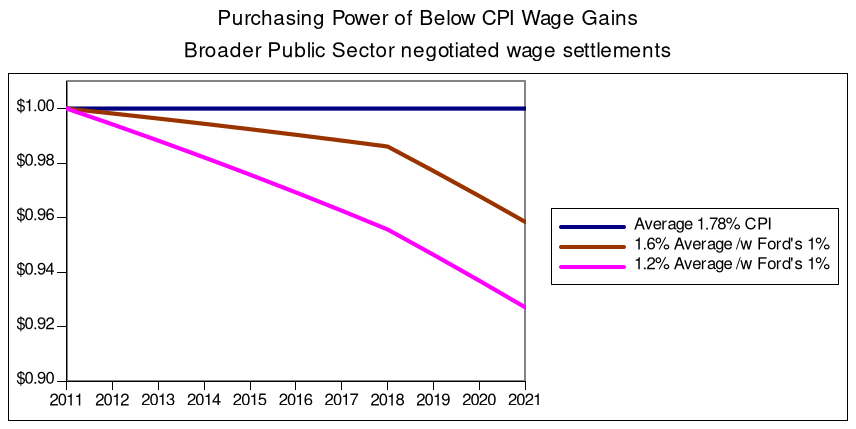

Below are two graphs1 of the change in some wages versus the Canadian Consumer Price Index. They show how "inflation" with lower-than-inflation wage growth can lead to large losses of real purchasing power for workers over time.

Fig 1: Broader Public Sector Wage settlements

In Canada, unionized public sector wage growth has been below the private non-union market – as well as CPI measures of "inflation" – for over a decade. Recent legislation limiting wage growth for public sector workers has exacerbated this trend.

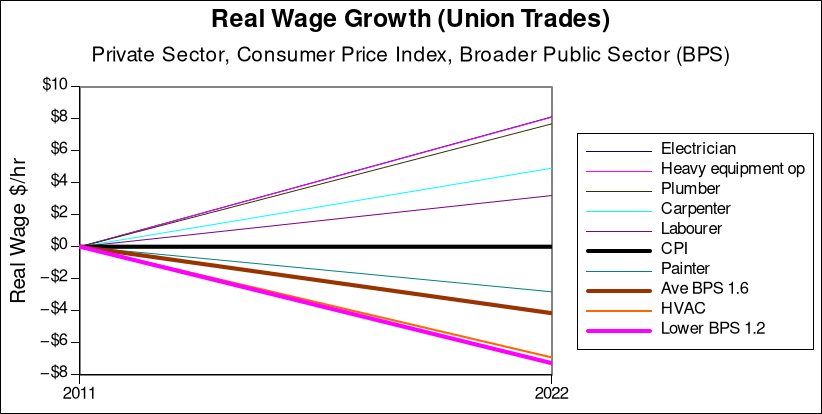

Fig 2: Private sector union vs BPS union wage growth

Another reason for inflation affecting workers' real wages so heavily is that workers under-estimate the long-term impact of signing a multi-year deal with below-inflation growth.

Union wages generally lag spikes in inflation growth because multi-year collective agreements have to expire before bargaining can try to make up the difference. But by then the damage to purchasing power has been done.

Labour supply issues in some private sector work have caused even slower growth in relative wages in the broader public sector compared to the private sector.

In the private non-union sector, a tight labour market can increase wages more quickly. However, the data suggest that non-union wage increases also do not change in a way totally in line with inflation. Private-sector wage growth is mostly driven by local profit concerns, labour market tightness, and labour power in negotiating wage contracts rather than inflation.

As explained below, these changes to wage growth undermine the (Post-)Keynesian view that wage growth is "causing" – or, really, has anything to do with real inflation at all. 2

Inflation, CPI, and cost data

Below you'll see how we usually get some information about inflation from our statistical agency, a jumbled mess of numbers that seem to contradict themselves. Growth over different stretches of time, rates of growth, different "baskets" of goods, local or provincial CPI numbers vs national numbers. It becomes very confusing.

Headline CPI grew in December at a faster pace compared with November, due in part to higher prices for food (+5.2%), passenger vehicles (+7.2%) and homeowners' home and mortgage insurance (+9.3%). Excluding gasoline, the CPI rose 4.0% year over year.

On a monthly basis, the CPI growth rates actually fell 0.1% in December, following a 0.2% increase in November. This was the first monthly decline since December 2020.

On a seasonally adjusted monthly basis, the CPI "was up 0.3%", which does not seem huge? Or, is it huge?

So, is inflation rising or falling? Is the speed of growth important? What is "high" versus "low" inflation? Compared to what?

Most people think that these CPI numbers are "inflation". But, most people do not realize, even on the Left, that CPI is a neoclassical view of inflation based on relative prices. Is that really what inflation is?

The answer is complicated, but these kinds of general price changes are not actually inflation, they are product of inflation.

It turns out that counting price rises is only one view of inflation.

Wages have not grown as fast as CPI and – as importantly – wages have not grown as fast as profit for the last few decades. For some, it is this slow rate of wage growth compared to the growth of net profits that is part of a better explanation of inflation than the orthodox views.

Classical economists/Marxist view

The classical view is that inflation occurs when the value of money in circulation declines.

Said differently, inflation is when a dollar coin yesterday was worth more than the same dollar coin today. Inflation is not driven by the price of a good, what looks like price increases is driven by your dollar losing value.

But, we are not done there because current inflation occurs within the social and political context of capitalism. From within a capitalist economy and from a classical view, inflation is the socialization of the cost of state borrowing that subsidizes profits without creating a corresponding increase in production. Inflation is currently the result of giving money to the owners of capital who are not using that money for anything productive.

Inflation can be the result of the pull of demand, the slow reaction of production causing a supply limit, and/or the over printing of money not applied to production. These all exist in the struggle between capital and labour. There is no easy rule based on a single measurement. Therefore, all other ideological explanations of inflation are incomplete. Either they are unhelpful in understanding inflation or incorrectly point to workers wages, blame social welfare and the poor, or other social supports.

Differences in the description of inflation

Different views on inflation based on political economic ideology. They can be briefly summed up as:

- Neoclassical

- Since all prices for all goods rise at the same time in response to the rate of money (availability) in the economy, inflation is unrelated to "relative price". This means price increases across the economy can be measured to get a value for inflation. In this view, inflation is related directly to the central bank printing too much money and merchants/market responding by increasing prices in response to everyone (more or less equally) having more access to more money.

- Keynesian

- Wage increases (basically) cause inflation. That is, just the supply of money to the people who buy things increases tightness (increases scarcity) in the economy resulting in fewer things available and thus the market responds with increased prices.

- Post-Keynesian

- Wages, rate of money in the economy, and supply limitation increases the price of goods which causes inflation. Wages and supply/demand pressures drive prices higher, wage increases are then gained by workers who cannot notice price increases which causes this faster inflation growth to be permanent. Very similar to Keynesian with the acknowledgement it is not just wages driving inflation.

- Classical

- Inflation results from too much money commodity (read: real money) compared to the actual total net value and/or net profit produced in society. If too little net value has been produced (goods and services) such that you can spend all money buying all goods and services in the economy you would end up with money left over with nothing to buy. This money left-over is what creates inflation. For Classical economists, inflation can be thought of as the correction of this over-production of money by "borrowing" value from future production. This "borrowing" results in a reduction in the value of the currency today. Just like buying something on credit that has interest makes a commodity more expensive to the purchaser, inflation makes things appear more expensive because money has become less valuable.

The focus changes the causation argument

The different economic ideologies focus on different things when counting/measuring inflation because they each determine the cause of inflation to be different.

Neoclassical economists focus on the Consumer Price Index for general price increases and the market's response to the result of inflation.

Keynesians focus on wage inflation and purchasing power. Too much wage growth means too much demand for the current supply.

Post-Keynesians focus on price inflation, supply chains, and wages. Not enough supply for the overall demands results in price increases. Monopolies can also cause price increases by increasing prices (essentially they control all supply and thus prices).

Classical/Marxists focus on many moving parts including (low) profit rates, net profit, production, value, crises, and include some of the Keynesian/neoclassical element of money creation by the state.

Solving the issue of inflation

The result is that these different ideologies have a different focus, resulting in very different policy options to "solve" inflation.

Neoclassicals want to raise interest rates in response to CPI increases. Essentially, not just print less money, but take money out of the economy, slow economic growth, and bring price growth down to a level that capital can deal with.

Keynesians want to cap wage growth. This is usually done through attempting to increase the supply of labour. Providing public employment, or a "guarantee" of employment, and increasing taxes are popular policy responses to higher inflation. These actions reduce money available for private sector employment, affecting aggregate demand, and therefore reducing growth and inflation.

Post-Keynesians want to clear-up opaque market price signals, support supply of goods/services to meet demand and cap wage growth. There are plenty who talk about interest rates and other forms of the cost of debt, but in the end it is about bringing the economy (supply and demand) back to some sort of price stability.

Classical/Marxists point out that inflation is mostly a product of regular and recurring capitalist crises. Capital is always trying to solve the issue of profitability. At the nation-state level there are consequences of just printing more money to try to solve profitability. Capital has to produce necessary things that people can buy, make a profit, re-invest in new production, employ workers. The state causes inflation by giving out money to capitalist firms that will not invest in any net new production.

Theories of inflation

We all assume that there are theories of inflation in all these economic ideologies. The reality is that none of them have a real "theory of inflation" – a testable framework of where inflation comes from – except Classical/Marxist economics.

One result of not having a theory of inflation is seen in Keynesian/Post-Keynesian arguments about "monopolies". Some have thought that monopolies cause inflation through unregulated prices/profit increases along with too much wage growth for workers. This understanding of inflation cannot predict inflation growth rates and cannot explain existing or historical inflation rates.

In fact, it is so obvious that wages do not cause inflation that the Keynesian tradition now explains this away by linking wage growth not to causing inflation, but making inflationary growth "permanent". This conveniently ignores that prices also go down and historical wages have fluctuated a lot more than changes in inflation. It is a cause-and-effect problem.

What about Neoclassical theory? It really just does not make a lot of sense at all.3 First, it is based on the notion that there is perfect competition between firms and that all prices are equalized along with a normal profit rate. This is false of course because not all firms have the same profit rate, but it also does not explain the fact that, sometimes, printing money does not result in price increases.

Classical theory does have a theory of inflation4 and many have shown that, when modeled, it can predict inflation rates. Unfortunately, it is difficult to measure "net profits" in society because capitalists do not like reporting such numbers. Capitalist countries also do not bother measuring production and profit rates as they rely heavily on the notion that the "market" should be left alone.

So, we are where we are now, never knowing what inflation is actually going to do?

Current causes of inflation?

There are competing theories of what is causing current inflation to pick up.

Artificially low interest rates and direct profit subsidies in the form of state support for profit rates has created this situation. And, it is helping to drive inflation. The state has printed money and given it to capital, and the capitalist firms have not, for the most part, used that money to invest in net new production. Instead, they simply kept much of it as "profit". Some of this money has made its way to the financial markets, where it is also not used for anything productive.

For example, while costs of housing debt for individuals has skyrocketed, property owners have seen this:

"For the third consecutive month, private non-financial corporations reduced their outstanding debt with Canadian governments as financial support programs continued to experience modest net repayments of borrowed funds."

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/220119/dq220119d-eng.htm?CMP=mstatcan

The companies that got bailed out are now profitable in spite of the economy barely producing anything. How is this possible? Through the magic of the financial markets "growing" with all that fictitious money. This has also increased the prices of real assets (such as property) faster than wages (i.e., net income for capital firms grew).

Impacts on labour union bargaining

Current rounds of bargaining will attempt to make back losses over the previous decade now that these "real wage" losses become more evident. In the public sector the cumulative real wage loss is becoming substantial in the tens of thousands for an average worker over their work life.

As such, wage increases will attempt to be above the predicted inflation rates. However, it is also important to consider other issues than simple consumer price increases. The growing difference between private sector and public sector wage growth should be taken into account.

The (legislated) low wage growth in the public sector (indicated in the above graphs) have started to impact recruitment and retention of skilled workers in the public sector. The result is casualization, outsourcing, and an undermining of long-term economic planning in public sector employers.

Several areas in bargaining must be considered in conjunction with "wages" such as pension funding costs and increases in medical benefits costs.

For pensions, risk must be put on the employer to fund any losses in the investment market. The loss in the markets of future wages for retirement are not the fault of the worker. Pension investment returns are a way that the employers/capital try to minimize the cost of future retirement costs. If these costs are paid for through reduction of benefits or increases to employee-side contributions, then capital has been effective in offloading their risky choices to the employees.

For medical benefits, there are additional changes that sought to reduce the burden of increased costs. Amalgamation of pools of benefits into larger, more diverse plans is one half of method to do this. The other half is removing the profits made from benefits providers. The public should expand public insurance for medical benefits provision.

The other response to increased wage growth (with the continuing availability of cheap credit) will be automation. However, with interest rates increasing, the rate of automation may slow. These changes to rates of automation have been discussed previously on CPress. As automation slows in the private sector, there is much room for introduction of automation in the public sector. These threats will continue to faces members and their employment. The best response is to bargain and enforce technological change language in collective agreements.

The regular threats continue to apply during funding crises in the public sector. Increasing the intensity of work and lengthening the workday will be requested by employers. These take the form of "productivity" programs and the introduction of technology, fad-based private sector management practices. With the shift in demographics to a younger workforce in much of the country, this will be a challenge to protect against.

The last threat to mention is the ever-present threat to outsourcing and downsizing. These threats are present even with the reduction of public sector wages as recruitment and retention are stressed. Public campaigns about value of the publicly owned public sector services and production will continue to be important in the short to medium term as neoliberalism maintains dominance in policy circles.

These graph are just for demonstration purposes. The "real" graphs with all the detailed yearly ups and downs of CPI are much worse. When "inflation" is higher than wage growth, it takes more than we lost to make up ground. A 1% loss from 100 gets you to 99, but a 1% gain from 99 does not get you back to 100, it gets you 99.99. Losses like this act as a ratchet and makes below-inflation wage growth in wages nearly impossible to make up.

Capitalism. Competition, Conflict, Crises (2016), Anwar Shaikh, Oxford University Press