Energy transformation/just transition is an economics problem

In the war against climate change, the main issue continue to be resource allocation. It is not so much that we do not know how to solve the problems we have created for ourselves, it is that we cannot agree on how to spend the money or even if we have the money to spend. These questions are political, but the facts are rooted in our understanding of the economy and the processes that drive value creation. The politics tend to come out of how you answer the economic question of resource allocation and how you think those resources are created in the first place.

Economics and survival

Making the deadline for humanity's survival is a problem of economics. That is, it is a problem of resource allocation: both direction, amount, and speed allocation of resources.

This might be possible for economics as a science to figure out. Unfortunately, there is no such agreed upon "economics" since the field of study is not a science but a political art form. And, as an art form, every individual can express a different supposed paths forward for transition and we swim in a sea of bad policy options.

I would submit that neoclassical economics—the dominant strain—is not set-up to deal with this transition at all. Indeed, there does not seem to be tools in this framework that can get us anywhere near where we need to be.

Indeed, the proof is all around us. If it was able to get us to transition, we would not be having this conversation as we would be hurtling towards climate salvation with companies making profits hand over fist.

Alas, that is not the situation and it is too easy to blame just "politics". The mechanisms to get investment to the correct place simply do not exist under the dominant economic paradigms driving the current structure of capitalism.

What do I mean by mechanisms? I mean the policies available under the rules established and articulated by the economists do not allow the amount of investment needed.

This is why you see announcement after announcement by politicians and yet no actual movement or change in direction. Panic continues to set-in as things get worse, but the only thing liberals understand they can do is nudge capital with public financed profit subsidies and establishing fake pseudo trading markets like the carbon markets.

Some of the numbers

Let's take a look at a few numbers without specifically identifying the mechanisms involved. All of the numbers, quotes, and graphs below are from Oil and Gas Industry in Net Zero Transitions, the International Energy Agency's climate reports.

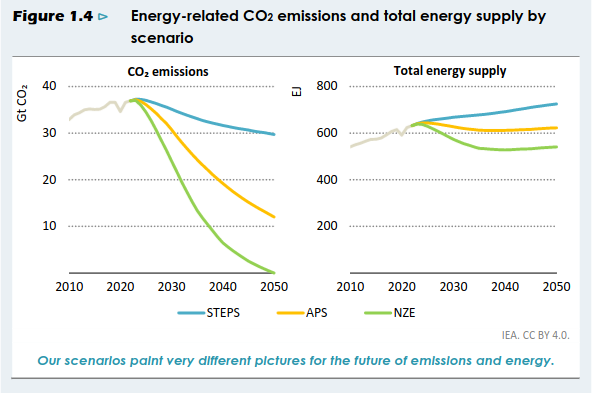

A couple things to keep in mind. The different scenarios get us to different outcomes.

- STEPS

-

is the stated policy scenarios. These are what governments and capital are actually doing. Best case, this keeps us at 2.4°C in 2100 with 50% probability. The tail on this probability means that it is likely going to be much higher than that.

- Sometimes the models look only at STEPS. Usually when they are talking about numbers because the numbers even under the STEPS are extremely large.

- APS

- is the stated policy scenarios. These get us nowhere near where we need to be, but it is what governments have stated they are going to do. We are not even reaching these.

- NZE

- is net zero by 2050. Not even really talked about in active policy circles any more, but would be necessary to bring us to 1.5°C with 50% probability.

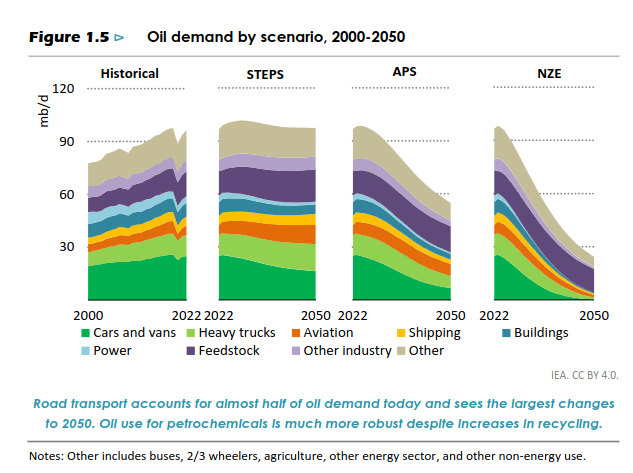

What does this do for oil demand in each scenario? As an example of the below, the NZE scenario would mean the end of ICE sales by 2035 everywhere on earth and massive increase in electric vehicles in use.

- Three-quarters of the oil used in 2050 is in sectors where it is not combusted.

- Around 0.8 Gt CO2 is emitted from oil use in 2050, mainly from aviation and trucks.

This graph is just oil, but the Natural Gas graph looks exactly the same. The NZE scenario is 75% lower demand than today:

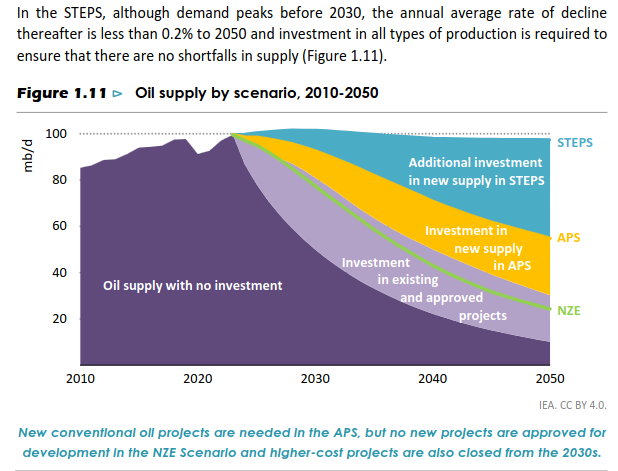

Also, keep in mind that the natural decline in current production investments mean that new investments are necessary even under the 1.5°C target. It is not apologist to say this and it missing from most environmental discussions around climate change.

However, the $800 billion invested each year is double what is required in 2030 to meet declining demand in a 1.5 °C scenario. By 2040, more than 7 million barrels per day of oil production is going to have to be pushed out of operation before the end of its technical lifetime in a 1.5°C (NZE) scenario.

All of these new project developments face major commercial risks and could also lock in emissions that push the world over the 1.5 °C threshold.

Dealing with this risk and cost has not been dealt with thus far under the capital investment models.

Reductions

Transitions can only work if all producers take targeted action to reduce their emissions. Not demand-lead emissions, but actual policy-driven reduction in production and simultaneous bringing on-line alternatives.

Indeed, saying the obvious is necessary because it is so frequently lost: oil and gas needs to wind down production to meet emission targets. And, investment needs to be made at the same time in not just replacement of this production, but to surpass that wind down.

"Wind down" means what is currently being done no longer is done in our lifetimes.

- Oil and gas demand needs to decline 2% each year on average to 2050.

- Even natural gas needs to start to decline before 2035.

Wind down will result in a 20% reduction of the 12M workers currently employed by 2050. That is over 240,000 workers globally, obviously more concentrated in producer countries.

The economic problem is that investments are always made on a timeline for returns. The wind down must happen before that return is achieved, which means real money is lost on these projects.

The ratio of investment is 1:5 oil/gas to green by 2030 from 1:1.8 today.

- 50% of oil and gas company capital budget would need to go to clean energy by 2030 from 2.5% today.

Because there will continue to be some production, energy companies are competing over who will be left standing.

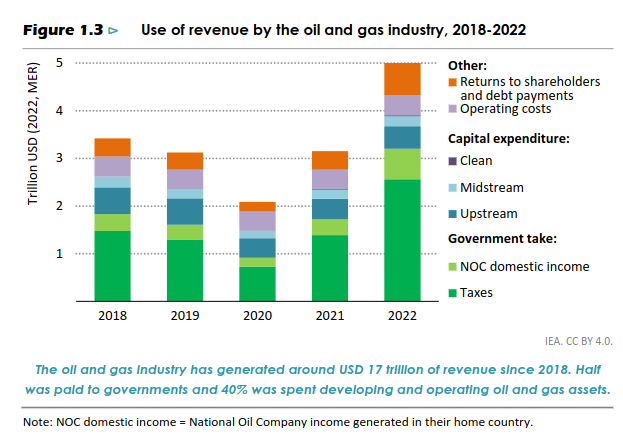

Where are revenues goig right now? Taxes and re-investment in capital.

Producer economies will have their per capita net income decline 60% by 2030 to reach 1.5°C. Economies have no way to deal with this kind of decline.

Since 2018, the annual revenues generated by the oil and gas industry have averaged close to USD 3.5 trillion. Around half of this went to governments, while 40% went back into investment and 10% was returned to shareholders or used to pay down debt.

Where will the decline need to happen?

Major resource holders are the historical oil and gas extraction countries and companies. The reason for Majors being the focus is that this report is written by the OECD's IEA, not because the decline needs to happen there needs to happen there.

- Majors hold less than 13% of reserves.

- National Oil Companies: 60% of reserves

Canada's oil is the most expensive in the world making it the target for reduction under almost all scenarios on cost and on security preference.

Revenue reinvestment

"Just Transition" is a concept of caring for displaced workers and their communities. There is a clear place for these workers to go, and it isn't in installing solar panels.

It is in mining.

Some 30% of the energy consumed in a net zero energy system in 2050 comes from low-emissions fuels and technologies that could benefit from the skills and resources of the oil and gas industry.

Because we need to sustain some investment, the question is where and how to manage this.

A complex economic question if ever there was one.

It is a neoclassical economic problem identified clearly in the report:

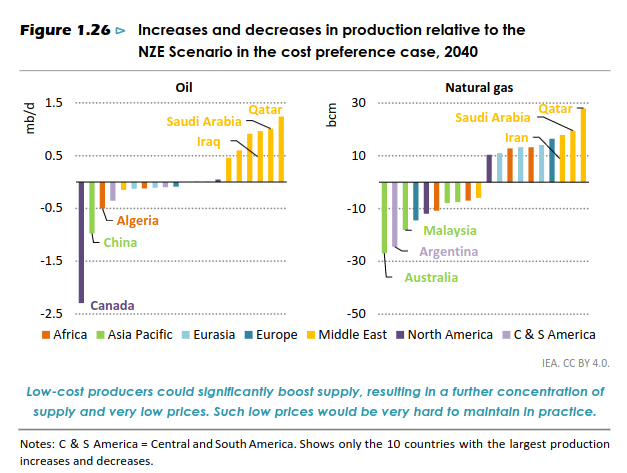

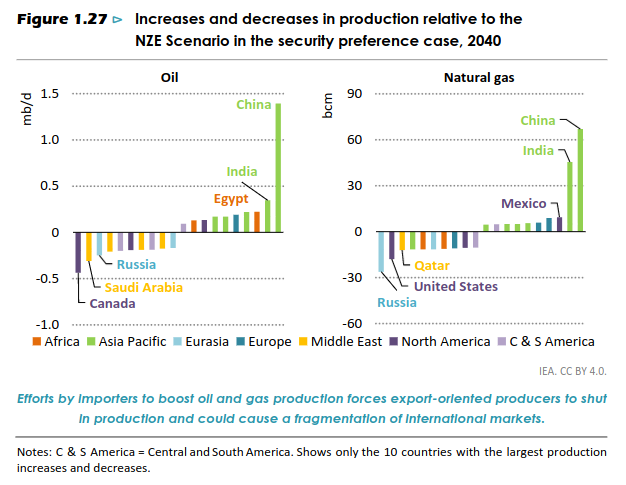

Market forces naturally favour the lowest-cost production, but that leads to a high concentration in supply among today’s major resource holders.

And, the investment side still does not quite work for green alternatives:

- Return on capital employed in the oil and gas industry averaged around 6-9% between 2010 and 2022 (with much higher variability than green energy).

- ROC on clean energy was 6%.

Even with all the subsidies, green energy is still not a great investment for those who have money already in oil and gas.

This is why oil and gas companies (and their shareholders) still only allowed $20 billion in clean energy to be spent in 2022. This is only 2.5% of its total capital spending.

- The oil and gas industry currently employs nearly 12 million workers globally.

- Per-capita income from oil and gas sales in the NZE Scenario in developing economies falls by 70% to 2030 and by 90% to 2050 compared with the average level between 2010 and 2022.

Much of the shift could be offset by investment in mining of critical minerals. Some oil companies are investing in mining, but it is not their specialty.

"Industrial Strategy" comes to mind as a solution, but then we have to remember that this is not allowed under a neoclassical economic program.

That said, the estimate is that the level of employment and activity in critical mineral mining expansion could be a partial solution to this.

Natural Gas

The 60% cut in scope 1 and 2 emissions by 2030 in the NZE Scenario requires around USD 600 billion of spending to 2030.

Methane emissions account for nearly half of the sector’s current scope 1 and 2 emissions. Tackling methane is the most important measure to reduce these emissions. Other key levers include: eliminating all non‑emergency flaring, electrifying upstream facilities with low-emissions electricity

- CCUS is part of this investment for Gas. However, the technology is not available.

Skill sets for gas workers overlap needed skills for 30% of necessary investments. But, this includes CCUS investments. More work needs to be done to match skills with other needed energy sub-sectors including geothermal, offshore wind, bioenergy, hydrogen, and chemical production.

What happens how?

Should companies invest in efficiency programs first? Or, should governments force the transition faster?

How you answer this depends if you think there is a finite amount of money/resources/people available to do energy transformation/transition/investment. And, how you measure needed investment in oil and gas to meet demand in the interim period during transition.

We know the numbers as they are outlined above, but knowing is not doing. And the doing is not happening (or likely even possible) under current policies.

An alternative needs to be provided. Not just in energy investment, but in economic thinking.